Earlier this month, a fire ripped through the Apollo/Transco vinyl production facility leaving only one remaining lacquer production factory in the entire world. The loss of such an integral facility is a massive blow to the vinyl record industry, with the aftermath undoubtedly affecting many businesses across the entire supply chain.

Initially, the outlook was pretty bleak; vinyl lacquers are a critical component in the record production process, and to lose one of only two producers globally was always going to cause a degree of panic. Shortly after the fire, Apollo released a statement through their website describing the aftermath:

“To all our wonderful customers. It is with great sadness we report the Apollo Masters manufacturing and storage facility had a devastating fire and suffered catastrophic damage. The best news is all of our employees are safe. We are uncertain of our future at this point and are evaluating options as we try to work through this difficult time. Thank you for all of the support over the years and the notes of encouragement and support we have received from you all.”

Firstly, it’s great news nobody was hurt—things could’ve been much much worse. However make no mistake, any disaster affecting a critical part of the supply-chain like this is a significant problem. There are so many businesses and great people invested in this industry, from artists to mastering engineers, and record pressing plants to independent record stores—many livelihoods are at stake. To find out where we go from here, Sound Matters spoke to a few folks in the know.

For readers in the UK and Europe, I can offer some degree of relief, as many mastering facilities across the region use lacquers from the Japanese-based manufacturer, MDC. One such mastering house is Alchemy Mastering in West London. Alchemy founder, Barry Grint spoke to us shortly after the fire to explain how the situation might affect his business. “In the short term, there is little change,” Barry explains. “The current position is that MDC will continue to supply their clients with the same volume of blank lacquers as they have historically used on average. They are not going to take on new clients, nor increase their prices.”

We were able to confirm the security of production further when speaking with French-based producers, MPO International. Their CEO, Alban Pingeot, echoed Barry’s reassurance. “Europe is mainly served by MDC (somewhere around 80%), so the fire will not affect our business short term. We might notice some delay over the coming months with new releases, and the market price for lacquers and cutting could be under pressure. For now, at least, it’s business as usual.”

The situation in the United States, of course, is a little different. Naturally, with the Apollo warehouse located in Banning, California, a far greater quantity of lacquers for vinyl mastering in the US were supplied by the ill-fated factory. Owner and Chief Engineer at Masterdisk USA, Scott Hull gave us his perspective. “In the short term, we’re ok,” he states. “I have a supply of lacquers that will sustain me a little more than a month. Long term, I am due to receive my normal allotment of lacquers from the Japanese plant. But I am concerned about cutting studios that do not have access to this facility.”

Not everyone is so lucky, with some panic already setting in, but this could be completely unnecessary. “I’m concerned to hear that several labels have already halted production on some of their planned releases for this year,” Scott continues. “I think that the decision is premature.

“I think it really depends on who you speak to; there are US-based cutting and pressing plants that are seriously worried about staying afloat – but in Europe, I hear a different, more optimistic story.”

I very much share Scott’s concerns about kneejerk reactions from the wider industry. There are a lot of talented folks in this industry, and I can already see the wheels in motion to secure a way forward. Scott appears equally optimistic: “I’ve had lengthy discussions with entrepreneurs that are launching into R&D and production to fill the void left by Apollo. I think the long term effect (beyond six months) will ultimately help the record-making business as there will be several more alternatives that grow new business and relationships.”

Barry Grint, also optimistic, is hopeful of new starters rising from the ashes. “No one wants to be in a position where there is total reliance on one supplier,” Barry states. “However, in the mid-term, I know of several people willing to invest in a new facility, so hopefully they will be able to secure the rights to a lacquer formulation and help build anew.”

Alternative Options

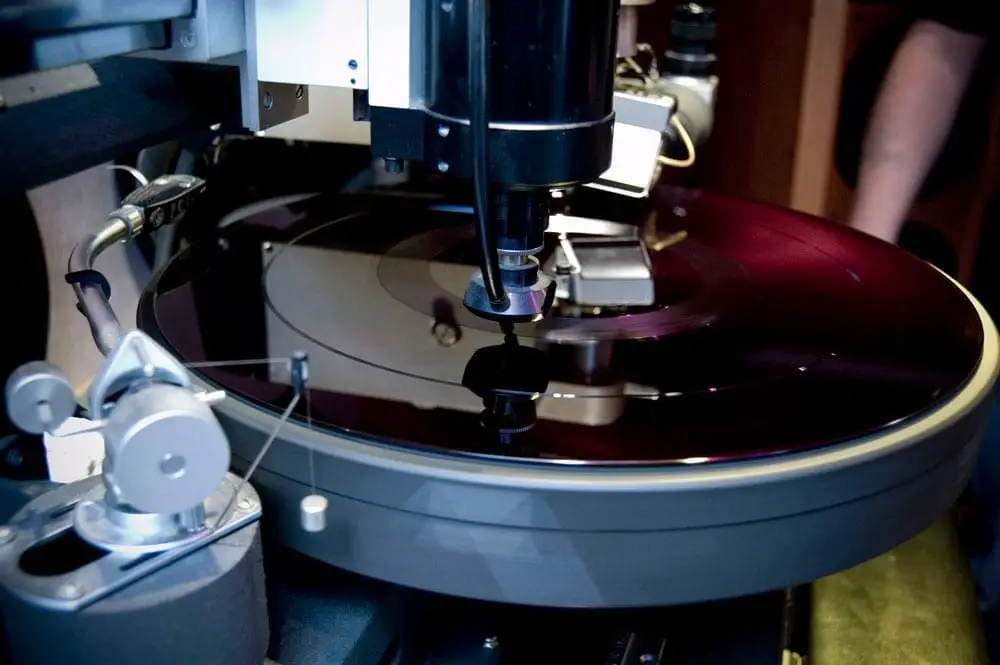

In the meantime, until we secure a long-term, sustainable solution, the industry needs a fix. The vinyl industry has experienced continual growth over the last 10-15 years, and nobody wants to see all of that undone. The show must go on. DMM (Direct Metal Mastering) is one alternative option available to help fill the void. DMM was co-developed by Neumann and Teldec. Instead of engraving the groove into a soft lacquer-coated aluminum disc, a DMM lathe engraves the audio signal directly onto a hard metal copper-plated master disk. This removes the first stage of electroplating from the vinyl manufacturing process, however many critics of DMM describe the cut as sounding too bright or “edgy.” Some DMM cuts can be 5dB quieter than a lacquer cut, which raises concerns that record buyers may notice the sudden drop in quality, which in turn could affect the resurgence of vinyl.

“The decision to use DMM vs Lacquer is a combination of cost and artistic value. The opinions on this are varied and personal.”

Scott Hull – Masterdisk USA

Despite some of these concerns, the mastering engineers we spoke to remained open to DMM, so long as it’s managed and allocated wisely. Barry adds: “Between the lacquer cutting rooms cutting frontline releases, and the pressing plants cutting other releases on DMM, the situation in the UK and Europe is reasonably stable. DMM cuts can be quieter than an equivalent lacquer cut, but provided the projects are allocated correctly, we should be able to continue for some time.”

Over in the US, Chris Hull also cites DMM as part of the solution but remains eager to continue using lacquer. “DMM is an option for Europe based projects and for those who have been buying their domestic US pressings from GZ Vinyl Pressing in the Czech Republic, he explains. “However, lacquers are still being made in Japan – I eagerly await the arrival of our next batch of lacquers! The decision to use DMM vs Lacquer is a combination of cost and artistic value. The opinions on this are varied and personal.”

Clearly, the industry is concerned but currently optimistic in its ability to manage allocation while the dust settles. There’s been a lot of hysteria generated by the media around this fire—dare I say, some of it is a tad sensationalist. The truth is, the fire is a huge setback, but in the longer term, there are plenty of reasons to believe it will lead to positive change that is long overdue.

“Pressure on the market will push manufacturers to investigate (and ideally accelerate) new alternatives, such as the HD-Vinyl, for example,” adds Alban Pingeot. “Also, we have been rebuilding the whole vinyl supply chain for the last ten years. Obviously, having only one lacquer manufacturer in the world is not sustainable or secure. A second or even a third one will be more than welcomed with open arms, as long it’s economically viable.”

The Industry Stands United

The new ‘Vinyl Alliance’ group shares Alban’s confidence in the industry’s ability to find a solution long term. In a recent press statement, the Vinyl Alliance, president Günter Loibl states: “There are already alternatives available, which will help bridge the shortage of lacquer discs. This can also be an opportunity to embrace new technologies and to strengthen collaboration within the industry.”

“Perhaps we can find a silver lining in this tragedy. Vinyl is an amazingly durable medium for music that has stood the test of time….”

Heinz Lichtenegger, Pro-Ject CEO

In the hours after the fire, Vinyl Alliance members gathered to discuss possible repercussions. Simultaneously, startups and individuals reached out to share their ideas. Soon it became clear that the impact on the industry will be limited in the long run as there are alternatives and options available besides the remaining MDC lacquers and DMM alternative. Specifically, their statement claims, “There are several startups planning to manufacture lacquers, and they are expected to enter the market in the coming months.”

Also: “New technologies such as HD Vinyl – a modern way to produce stampers without lacquers – are in development.”

Speaking directly as a member of the Vinyl Alliance, Heinz Lichtenegger, Pro-Ject CEO, is confident in a bright future for the vinyl industry: “Perhaps we can find a silver lining in this tragedy. Vinyl is an amazingly durable medium for music that has stood the test of time. We have seen cassettes, 8-Tracks, micro-cassette, reel-to-reel, Mini-Disc, LaserDisc, and CED discs all come and go, but the vinyl LP is more cherished than ever. It is a format important to the industry, to the artists, and to millions of fans!”

All This and Styli Too!?

No investigation into the recent fire would be complete without acknowledging the plant’s contribution to cutting styli production. Some years ago, Apollo bought-out the competitor, Transco, and subsequently started manufacturing cutting lathe styli. When speaking to Scott Hull, he told us, that “frustratingly, on the day of the fire, I was about to place a fresh order of cutting styli.”

Barry Grint was able to clarify the position on cutting styli: “Transco also manufactured the styli used for cutting the groove. Adamant (the manufacturer in Japan) is willing to increase their capacity to meet the demand for Neumann styli users. The short term situation in the US is difficult as they mainly used Transco for both blank lacquers and styli. Cutting rooms using Neumann cutting heads should be able to purchase styli from Adamant, but those Using Grampian and Ortofon (for example), will be without service.”

Press On

Short of possessing a crystal ball, it’s impossible to predict the full long-term impact. However, we can draw a handful of conclusions from our discussions across the industry. The situation in Europe remains relatively stable, while the US market is under significant strain. It’s safe to say (in the short term, at least) consumers will notice very little change. Even in the US, production will continue as normal while the current supply of lacquers and styli remains. The longer-term impact will depend greatly on how quickly the industry can react with interim solutions and the replacement of Apollo/Transco services.

Hoping to offer some reassurance to Sound Matters readers, I spoke further with Scott Hull about how the situation might impact consumers directly. Luckily, there’s reason to believe the impact on vinyl fans will be minimal.

“Except for some very high profile lacquer cut re-issues, I doubt the consumers will notice,” he reveals. “I, for one, think that having fewer projects in the pipeline will allow pressing plants to get caught up and return to a 3- 4-week production schedule – thus speeding up the time it takes to get a title through to market. But I am concerned about having enough business to retain employees.

“Going forward, the development of new startups and technology will help decentralize important assets. Most importantly, we need assurance that the knowledge and expertise necessary to make these support products is not lost in the fire. We do not yet know if any experienced operators or technicians from Apollo will move to another location to continue – or if Apollo will rebuild. It’s too soon to know.

“Positively, it’s been just over a week, and already many new operations are being launched. This is a very close-knit community, and communication is already quite good between suppliers. Smart minds will find solutions, and we will soon have more lacquers than we need.”

For me, the last comment encapsulates our sentiments perfectly. Yes, there will be some disruption, that much is inevitable, but in the end, resilience will prevail. Where there’s a will, there’s a way. To quote Churchill, “You can measure a man’s character by the choices he makes under pressure.”

For more discussion about this topic, please check out Scott Hull’s podcast, Making Vinyl at Masterdisk.

Hi, notice you used my image of a vinyl lacquer cutting machine (this was a machine located in Abbey Rd Studios), please can you credit the image to me, Mark Sng. Thanks.

Hi Mark. This image was purchased from Shutterstock and does not require me to show credit. However, I’m willing to credit this if you can prove ownership of the image. The artist under Shutterstock shows as Mark Sun, not Sng.

[…] just look at how the industry reacted with sharp precision in the wake of February’s disastrous Apollo Masters fire. Arguably, consumers will always want music, and with more people working from home, or perhaps […]

[…] if the vinyl record industry hadn’t suffered enough in the wake of February’s disastrous Apollo Masters fire, along comes a global pandemic. The fallout of COVID-19 (Coronavirus) is hitting the entire economy […]